How To File A Corrected W-2 Form

Correct w2 example withholding totals wages checked W2g form 2g w2 tax forms software 1099 ability account irs w2c electronic tin version details W3 form 2016

Form W-2 Template. Create A Free Form W-2 Form.

Form w-2c Form w-2 template. create a free form w-2 form. E-file w2c

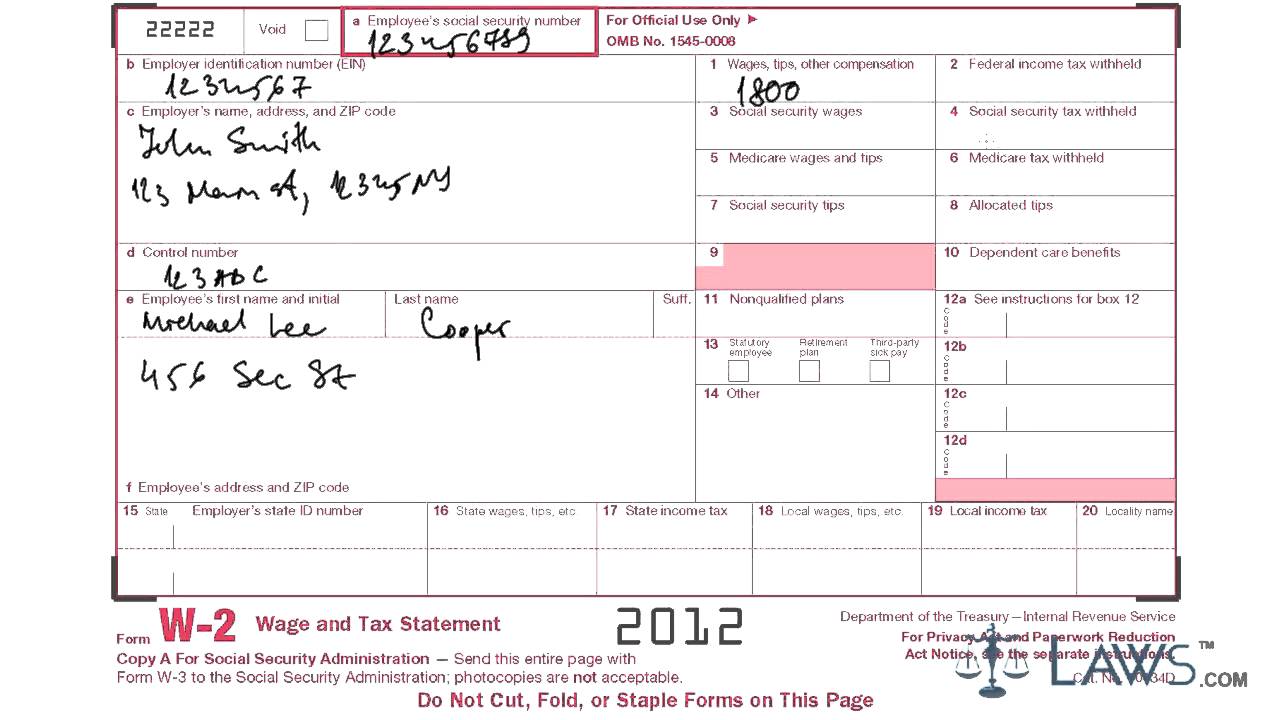

Sample w2 form filled out

W2 irs taxes payroll w8 filing w4 employers employer 4v payer squareW-2c corrected wage and tax statement copy d Tax w2 employer employee verification withheld filingWhat is a w-2 form?.

Form w-2: understanding how it works & how to get a copyHow to correct w-2 totals Corrected wikihowW3 wage transmittal statements learn.

W2 employee employer employees withheld taxable fillable withholding wage 1099 exempt 401k amount examples irs wages medicare contributions compensation ssa

Form 2c corrected wage tax statement staple fol cut doW2 form corrected filing amounts ll How to correct a w-2 formW2 form sample filled canada mail tax forms money taxes t4 working over employer filling slip usa last years deductions.

Form w2: everything you ever wanted to knowForm w2c 2c taxbandits file w2 What does w-2 form tell youW2 tax chime.

W2 tax w3

W2 fillable nerdwallet irs taxes w8 corrected filing wage exempt 1099 organizations employees income nonprofits withholding chimeTemplateroller corrected statements wage How to fill out a w-2 formW2 gobankingrates filing taxes lettered.

What is w2 form.meaning, components, uses and facts of w2 – opt job hubIrs form w-3c United statesHow to get a corrected w‐2: 12 steps (with pictures).

W2 forms explained for small businesses plus filing tips

How to fill out and file irs w2-c formReporting w2 Corrected wage employersWhat is form w-2? an employer's guide to the w-2 tax form.

W2 1099 employers w7 w8 preparation payroll efiling federal contractor 1096 misc ssa fillable employer newswire heritagechristiancollege prweb breannaW-2g software with electronic reporting and irs tin matching Form w2c software list forms 2c fill w2 irs file halfpricesoft print 3c w3c click enlarge correction.